| About |

| The Results Wave COVID-19 Wave 28 Wave 27 Wave 26 Wave 25 Wave 24 Wave 23 Wave 22 Wave 21 Waves 11-20 Waves 1-10 |

| Working Paper Series |

| Related Research |

| Authors |

| Sponsors |

| FAQ |

| Contact |

| Press Room |

|

Chicago Booth/Kellogg School Financial Trust Index reports historically high level of public trust in American financial institutions

Wave 28 Results

Financial Trust Index

Paola Sapienza and Luigi Zingales1

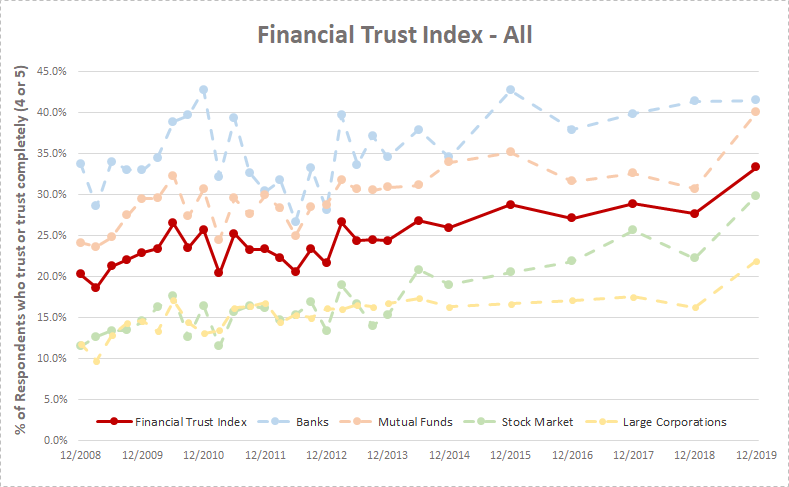

Overall levels of public trust in financial institutions rose from 27.6% in 2018 to 33.3% in 2019 – the highest measure of trust since the first wave of FTI data was collected in 2008. The growth was largely due to an increase of trust in mutual funds, the stock market and large corporations. Key findings include:

ABOUT THE FINANCIAL TRUST INDEX: The Financial Trust Index was created in 2008 as a means to study changes in trust in the financial industry and the impact of trust on investors’ decisions. The index monitors the annual level of Americans’ trust in institutions and regularly evaluates how current events, policy and government intervention may affect it. The initiative is sponsored jointly by the University of Chicago Booth School of Business and the Kellogg School of Management at Northwestern University, and is administered by Social Science Research Solutions. ABOUT THE SURVEY: On an annual basis, the Financial Trust Index captures the level of trust that Americans have in institutions. This study was conducted for the Financial Trust Index via telephone by SSRS, an independent research company. Interviews were conducted during the period of December 17–26, 2019, among financial decision makers. A total of 1,019 interviews were conducted, with a margin of error for total respondents of +/-3.57% at the 95% confidence level. More information about SSRS can be obtained by visiting www.ssrs.com. 1 Paola Sapienza is the Donald C. Clark/HSBC Chair in Consumer Finance Professor at the Kellogg School of Management at Northwestern University. Luigi Zingales is the Robert R. McCormack Distinguished Service Professor of Entrepreneurship and Finance and the Faculty Director of the George J. Stigler Center for the Study of the Economy and the State at the University of Chicago Booth School of Business. |

|